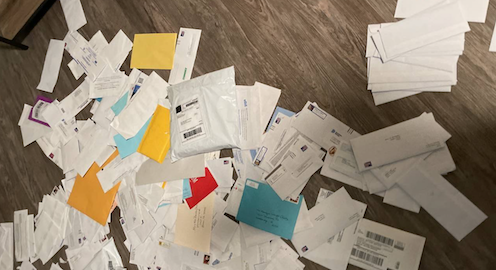

Loot stolen from the U.S. Postal Service is displayed on the dark web. Via Evidence-Based Cybersecurity Research Group

The types of crimes that use drop accounts are multiplying rapidly, but there are ways to decrease your chances of becoming a victim.

Do not mail checks from anywhere but your local post office. Not even your own mailbox is safe. The best option? Pay bills and send money online.

Protect your identity online by following these steps

Guard your Social Security number. Never use it on medical forms – if asked, write “available upon request” – for a job interview, when applying for a grocery store reward card or when booking travel. If you believe the number has been compromised, contact the Social Security Administration to get a new one.

Use only one credit card for online shopping, and never use a debit card.

Strengthen your online and mobile phone passwords.

If you don’t expect to apply for a credit card or loan soon, freeze your credit with all three credit rating agencies.

Check your credit reports.

Do not respond to preapproved credit card or loan offers delivered by mail, and, to reduce offers, consider opting out of receiving these mailings.

Shred your financial information; don’t simply throw it out.

Never give out personal information to anyone contacting you through unsolicited phone calls or emails.

To prevent fraud involving a tax return refund or any other tax issue

Complete and send in your tax return as early as possible, which makes it more difficult for someone to steal your refund.

Establish an identity protection PIN with the IRS, which only you and the agency will know.

If the IRS rejects your attempt to file your tax return, or if you receive any unusual mail from the agency such as a tax transcript you didn’t request, or it notifies you of suspicious activity, contact the agency at the number listed here to report possible identity theft.

Pay any taxes owed online, not by check.

To prevent losses through business email compromise scams

Learn and teach employees basic email safety techniques.

Confirm urgent emails from supervisors or vendors demanding immediate wire transfers. In fact, urgent requests are the most suspicious.

Assure employees that double-checking whether these purportedly urgent emails came from the listed sender will not result in criticism or punishment.

Never purchase a gift card requested by a supervisor through email or text.

– Human resources officials should never change bank accounts for direct deposit if employees ask by email or text. Always call to double-check that the request is real.

This article accompanies Heists Worth Billions, an investigation from The Conversation that found criminal gangs using sham bank accounts and secret online marketplaces to steal from almost anyone – and uncovered just how little being done to combat the fraud.

Kurt Eichenwald does not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.